In an investment environment marked by interest rate volatility, inflationary pressures, and shrinking margins, asset managers are under more pressure than ever to find stable, high-yield opportunities. Traditionally reliant on equities, bonds, and institutional vehicles, more asset managers and individual investors are expanding their reach into private real estate lending—not just for returns, but as a strategic hedge against market uncertainty.

Private lending offers the kind of speed, control, and risk-adjusted yield that’s tough to beat in today’s climate. In this post, we’ll explore why savvy asset managers and individual investors are turning to this niche and how it fits into a broader portfolio strategy.

The Appeal of Private Lending for Asset Managers and Individual Investors

At its core, private lending is short-term, asset-backed debt. Unlike equity, it doesn’t require a long hold. Unlike public debt, it’s not beholden to institutional red tape or slow-moving markets.

Private real estate lending—particularly fix-and-flip and bridge financing—offers asset managers and individual investors:

- Short-duration exposure (often 6–18 months)

- Collateralized positions backed by tangible real estate

- Predictable cash flow via interest income

- Senior lien status in case of default

- Inflation protection through variable rates or pricing power

In other words, it’s a rare combination: liquidity, security, and yield—all in one.

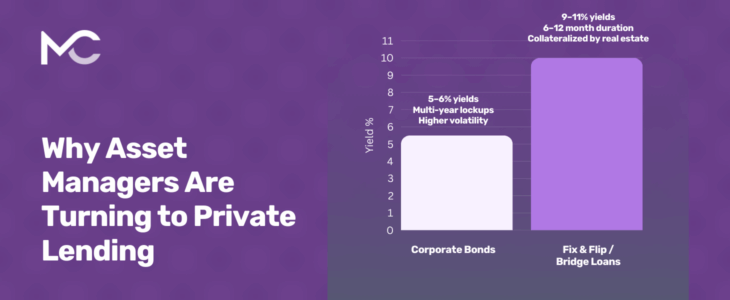

Compare this to traditional investment-grade corporate bonds yielding 5–6% with multi-year lockups. A well-structured fix-and-flip loan from a private lender may generate 9–13% annualized returns in half the time—with less volatility.

Real Estate Debt as a Hedge

For asset managers already exposed to equities or REITs, direct lending offers a powerful hedge.

- When property values dip, debt holders remain in the safest position.

- When interest rates rise, short-term loans can be repriced accordingly.

- When bank lending dries up, private capital becomes even more essential—driving deal flow and improving terms for lenders.

This is particularly attractive during downturns or periods of tightening credit, as seen in recent Fed cycles. With traditional banks pulling back, experienced operators still need capital—and private lenders step in, often with stronger protections and higher yields.

For a deeper look at recent lending trends, visit Mortgage News Daily.

Case Study: Using Short-Term Real Estate Debt to Improve Portfolio Efficiency

A multi-family office managing $100M in client assets needed a way to improve yield on idle cash allocations without committing to long-duration bonds. By allocating $2M into private lending via fix-and-flip loans across New York, Florida, and Georgia, they were able to:

- Deploy capital in under 15 days

- Generate a net 10.5% annualized return

- Rotate cash into new loans every 6–9 months

- Maintain senior lien positions with 65% LTV or lower

The result? Better cash utilization, lower volatility, and happy clients.

Working With Private Lenders Like Malve Capital

Private lending isn’t something asset managers or individual investors need to build from scratch. By partnering with seasoned direct lenders like Malve Capital, managers gain access to:

- Pre-underwritten, low-risk real estate deals

- Borrowers vetted for experience, collateral, and exit strategy

- Transparent loan terms and performance tracking

- Flexibility in deal size, timeline, and geography

You don’t need boots on the ground or a construction background. You need a capital partner who understands how to manage risk, preserve capital, and deliver results.

Learn more about how partnerships work by reviewing resources from BiggerPockets.

Final Thoughts

Asset managers or Individual Investors looking to increase yield, lower duration, and hedge equity exposure are finding a powerful tool in private real estate lending. In an unpredictable market, short-term debt secured by real property offers a rare mix of control and upside.

Private lending may not be the flashiest asset class—but for the thoughtful manager, it can quietly deliver outperformance while protecting downside.

If you’re managing portfolios and want to explore how private lending can support your investment thesis, contact the Investor Relations team at Malve Capital today. We specialize in low-doc, fast-closing real estate loans designed for smart operators—and smart capital.