Why Summer Is the Smartest Time to Refinance Your Rental Property with Malve Capital

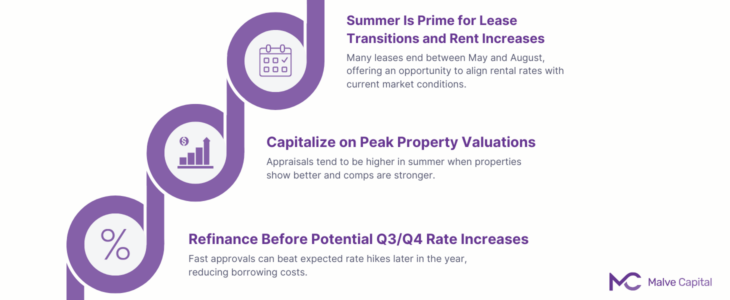

For real estate investors focused on long-term wealth building, timing your refinance matters just as much as finding the right lender. Summer offers unique advantages for refinancing rental properties—especially if you're looking to pull cash out to fund your next deal, lock in a long-term fixed rate, or lower monthly payments to...

How Do You Calculate Profitability Using the BRRRR Method?

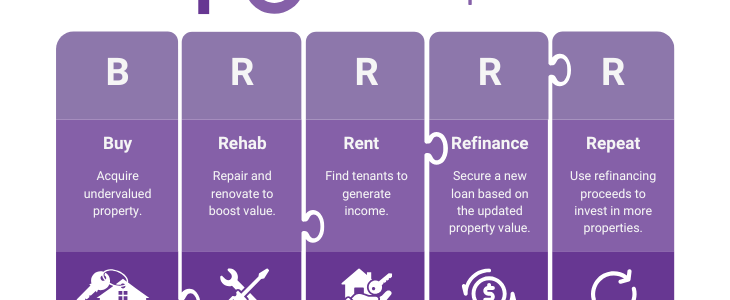

The BRRRR method—Buy, Rehab, Rent, Refinance, Repeat—is one of the most powerful strategies for real estate investors looking to build wealth. By recycling capital, investors can scale their rental portfolio faster without constantly tying up cash. While the BRRRR method can be highly profitable, success depends on accurate calculations at every stage.

The Benefits of Using a DSCR Loan for Real Estate Investing

Financing real estate investments doesn’t have to be complicated. If you’re a real estate investor, you’ve probably encountered roadblocks when applying for traditional loans—whether it’s strict income requirements, slow approvals, or limits on how many properties you can finance. That’s where Debt Service Coverage Ratio (DSCR) loans come in.

What Credit Score Do You Need to Apply for a Loan with Malve Capital?

One of the biggest challenges many real estate investors and developers face is qualifying for financing through traditional lenders. Banks and other financial institutions rely heavily on credit scores to determine eligibility, leaving those with less-than-perfect credit struggling to secure the funding they need.

If you’re worried that your...

Strategies for Real Estate Investors When Inventory is Scarce

Investing in the real estate market with limited inventory can feel like a constant uphill battle. Quality properties are harder to find, competition is fierce, and opportunities seem to disappear as quickly as they arise. For investors, this environment demands a creative, proactive approach. The good news? Scarce inventory doesn’t mean no...

How Do I Apply for a Hard Money Loan?

Hard money loans are well-suited for investors seeking quick, flexible financing solutions. Unlike traditional bank loans, hard money loans are asset-based and provided by private lenders. They focus primarily on the property's value rather than the borrower's creditworthiness. Here’s how to apply for a hard money loan with Malve Capital, the...

The BRRRR Method of Real Estate

For real estate investors, maximizing returns while building a sustainable portfolio is key to long-term success. One strategy gaining traction in recent years is the BRRRR method. BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat, and it’s a systematic approach to building wealth through real estate.

Whether new...

What Are Residential Development Loans?

Residential development loans are designed to finance housing projects, including single-family homes, townhouses, and apartment complexes. Residential development loans can help turn blueprints into thriving communities by providing capital to acquire land, plan infrastructure, and construct housing units.

How Do Residential Development Loans Work?

Thriving Real Estate Markets to Consider in Ohio

Ohio's real estate market is experiencing significant growth, with several cities emerging as prime investment opportunities. Factors such as affordability, economic development, and quality of life contribute to the appeal of these markets. Ohio's diverse economy and growing population make it an attractive region for seasoned and new investors. Here's a closer...

Maximizing Returns: Using Fix & Flip Loans to Transform Distressed Properties

Transforming distressed properties into high-value assets is an exciting and potentially lucrative opportunity for real estate investors. Fix-and-flip loans offer the flexibility and funding needed to complete renovations and maximize returns. Here’s how you can leverage fix-and-flip loans to turn distressed properties into profitable investments.

What Is a...

Thriving Real Estate Markets to Consider in Arkansas

If you’re looking to invest in real estate, Arkansas offers a variety of thriving markets, each with unique growth potential and investment opportunities. From bustling cities with booming economies to charming towns with steady demand, Arkansas has a dynamic real estate landscape that can benefit both seasoned investors and first-time buyers.

Is Bridge Financing Safe?

For many real estate investors and business owners, bridge financing can feel like a lifeline – a short-term solution that helps you secure a property or complete a project while you wait for longer-term financing. But is it safe?

Knowing what to expect can help you decide if it’s...

Maximizing ROI with Development Loans

Real estate development offers substantial profit potential, but securing the right financing is crucial for maximizing return on investment (ROI). Development loans can provide the capital needed to fund projects, from new construction to large-scale renovations. Leveraging these loans effectively can help developers, investors, and buyers maximize their ROI.

How Construction Loans Support Sustainable Projects

Sustainable building practices are transforming the real estate industry, with more developers opting for eco-friendly construction methods. However, these projects often require substantial upfront costs, making construction loans essential to financing. Here’s how construction loans support sustainable projects and contribute to a greener future.

Funding Green Building Materials

Thriving Markets to Consider in Mississippi

Mississippi offers many opportunities for investors, developers, and buyers alike. With a steadily growing economy and attractive real estate prospects, it’s no surprise that more people are considering the Magnolia State for their next investment.

Whether you're interested in commercial development or residential properties, several markets in Mississippi...

5 Tips for Choosing the Right Bridge Loan for Your Real Estate Needs

Bridge loans can offer a flexible and efficient way to finance real estate projects, bridging the gap between your immediate financing needs and securing long-term funding. While bridge loans can be valuable tools for real estate investors, developers, and buyers, selecting the right one is essential to maximizing your return...

What Is Bridge Financing?

Bridge financing is a short-term loan designed to help real estate investors and developers quickly secure funding for property purchases or development projects. These loans "bridge" the gap between the immediate need for capital and the long-term financing that may take longer to secure.

Whether you're looking to purchase...

Using Asset-Based Loans for Renovations & Improvements

Asset-based loans can be a smart way to fund renovations and improvements when you need quick access to cash. Unlike traditional loans that rely heavily on your credit score, asset-based loans use your existing assets, like property or equipment, as collateral.

This makes them an attractive option for...

Navigating Zoning Regulations with Development Loans

Zoning regulations can impact any development project. These rules dictate what you can build, where you can build it, and how your project must conform to local land use guidelines. Adhering to these regulations can be complex and time-consuming, but it’s essential for the success of your project.

At...

What Happens If Your Real Estate Sale Falls Through?

When a real estate sale falls through, it can be frustrating and stressful for both owners and investors. Whether the deal collapses due to financing issues, inspection problems, or a change of heart from the buyer, the outcome can leave you uncertain about your next steps. Understanding why the sale didn’t go...