You’ve got the vision. Maybe it’s a four-unit multifamily project in Atlanta or a sleek row of new-builds in Dallas. You’ve got the team, the plans, and even the permits. But one thing stands between blueprint and build: financing.

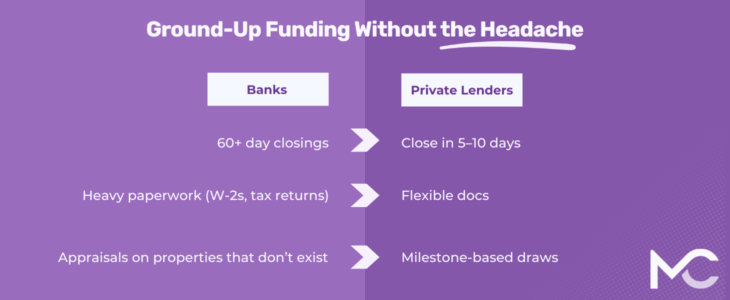

If you’ve ever tried to get a construction loan from a traditional bank, you already know the drill—slow, paper-heavy, and often dead on arrival. But there’s good news: ground-up doesn’t have to mean “ground to a halt.”

In this guide, we’ll show you how to get the funding you need to break ground fast—with flexible terms, deal-first underwriting, and a lender that understands builders.

Why Traditional Construction Loans Fall Short

Let’s be honest: banks were built for mortgages, not builders. Their checklist looks like this:

- Full set of stamped architectural plans

- Finalized permits

- Tax returns, W-2s, and full income verification

- 60+ day underwriting with a list of conditions

- Appraisals on a property that doesn’t yet exist

For experienced developers—or those working on a tight timeline—that’s a non-starter.

In today’s competitive landscape, speed to shovel matters. And capital partners should enable your momentum, not stall it.

The Private Lending Advantage

Private construction loans are short-term, asset-based financing tools built specifically for investors and developers. They’re designed to prioritize:

- The deal, not your personal finances

- Your track record, not your tax returns

- Your timeline, not theirs

At Malve Capital, we specialize in ground-up construction loans that close in days, not months. Whether it’s single-family infill or multifamily new-builds, our process is tailored to real-world developers—not spreadsheet bankers.

Features of a Private Construction Loan

- Loan Amounts: $250K–$5M+

- Closing Time: 5–10 business days

- Terms: 12–24 months, interest-only

- Draw Schedules: At your discresion

- Underwriting: Based on project budget, ARV, and exit plan

There’s no one-size-fits-all. We look at the entire project—purchase price, hard and soft costs, permits, comps, and the path to payoff.

Explore more on project-based lending at Investopedia

What You’ll Need to Apply

The paperwork is lean—but smart. Most direct lenders will ask for:

- Lot purchase contract or deed

- Project budget (hard and soft costs)

- Building plans

- Permits or timeline for permits

- Exit strategy (sale, refi, or rental conversion)

- Contractor info (use BuildZoom to find pre-vetted pros)

If you’re working with an architect, engineer, or general contractor, that’s a plus—but not always required to get started.

Ground-Up Capital Stack: A Quick Breakdown

Most successful developers blend capital sources to reduce risk. A typical stack may include:

- Private construction loan (senior debt)

- Builder equity or investor capital

- DSCR loan for refinance (if holding the property)

Malve Capital offers senior debt for acquisition and vertical construction—often up to 85% LTC.

How to Avoid Common Pitfalls

Ground-up is full of opportunity—but it also comes with landmines. Here’s how to steer clear:

- Don’t under-budget

Always include contingency reserves. Unforeseen delays are real. - Don’t ignore the market comps

If the finished product won’t comp out, you won’t exit cleanly. Use local agents to verify ARVs. - Don’t wait for permits to secure financing

You can often get conditional approval while your permits are in motion. Time is money.

Real Example: The Brooklyn 3-Pack

An investor came to Malve Capital with a plan to tear down a duplex and replace it with three luxury townhomes. He had the land under contract but needed fast capital right after permits cleared.

We approved a $1.2M construction loan in 6 business days, released the first draw a week after acquisition, and structured the rest around the investor’s milestones and requests. 12 months later, the units sold for $3.6M total.

Zero bank involvement. Zero red tape. Just real progress.

Final Thoughts

In today’s market, the difference between breaking ground and breaking even often comes down to your lender.

Traditional banks still operate in the past. But private construction loans give builders a new blueprint: speed, flexibility, and real-world understanding.

Whether you’re building your first spec home or scaling up to multifamily, Malve Capital is your capital partner—designed for developers.

Ready to go vertical? Let’s talk. Our team can issue a term sheet on the call and help you fund your ground-up project without the headache.