4 Reasons Why Real Estate Investors Use Bridge Loans

In real estate, timing is everything. Whether you're scooping up an underpriced property at auction, racing to close before a competitor, or bridging the gap between purchase and permanent financing-delays kill deals.

That’s where bridge loans come in.

Bridge loans are short-term, asset-based loans designed to keep your deal alive while you transition from...

From First Flip to Full-Time: Scaling Your Business With Private Capital

Most real estate investors remember their first flip vividly—the nerves at the closing table, the scramble to manage a contractor, the thrill of watching a dated property transform under their budget and timeline. But for some, that first successful deal isn’t just a win—it’s a turning point.

The real...

5 Funding Mistakes First-Time Real Estate Investors Make (and How to Avoid Them)

Breaking into real estate investing is exciting—but it’s also loaded with landmines. For first-time investors, funding the deal is often where things fall apart. Whether it’s overestimating what banks will offer, underestimating timelines, or choosing the wrong partner, a bad funding move can destroy your margins - or the deal altogether.

Fix and Flip in a Hot Market: How to Stay Competitive With Fast Cash Offers

If you’ve tried to land a fix-and-flip deal in the last year, you know the drill: by the time you finish your walk-through, four offers are already in—and one of them is cash. It’s no secret that competition is fierce in today’s real estate market. Demand is outpacing supply in dozens of...

Syndication vs. Joint Venture: Choosing the Right Structure for Growth

As a real estate investor, there comes a moment when you realize you can’t do it all alone. The single-family flips were a great starting point—but now, you're eyeing bigger opportunities: multi-unit renovations, ground-up construction, or acquiring mid-size rental portfolios. That’s when you face the question: should I structure this as a...

The 5 Fastest-Growing States for Real Estate Investors in 2025 (And How to Fund Deals There)

In real estate investing, timing and geography are everything. And in 2025, investors across the country are tracking five states that are exploding in both population and opportunity. Whether it’s surging rental demand, booming job markets, or investor-friendly policies, these markets are becoming magnets for deal-makers—if you can fund fast enough to...

Private Lending in a Tight Credit Market: Why It’s Booming

In a world where access to capital defines your pace and potential, the rules of the game are changing fast. Over the last 18 months, banks have pulled back—tightening credit requirements, slashing approvals, and increasing the scrutiny on every single borrower.

But one sector hasn’t flinched: private lending. In...

How to Build a Reliable Financing Stack in Unpredictable Markets

In 2025, one thing is certain: the market is uncertain. Interest rates remain volatile, traditional banks are tightening credit, and deal timelines are compressed. For real estate investors, that means a static capital strategy is a liability. The investors who will thrive in this cycle are those who know how to stack...

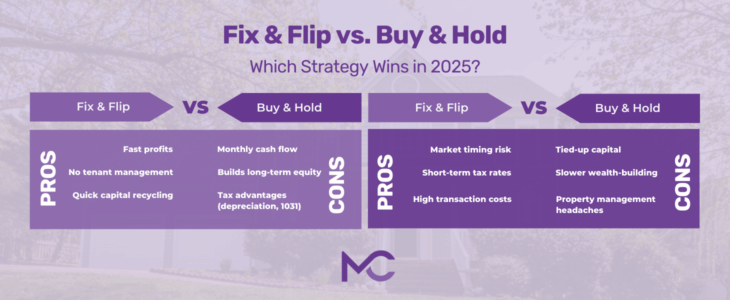

Fix and Flip vs. Buy and Hold: Which Strategy Wins in Today’s Market?

If you’re exploring real estate investing in 2025, you’ve likely asked yourself: “Should I flip this house or rent it out long term?” It’s one of the most critical decisions an investor can make—and it comes down to your goals, risk tolerance, and how quickly you need capital to work for you.

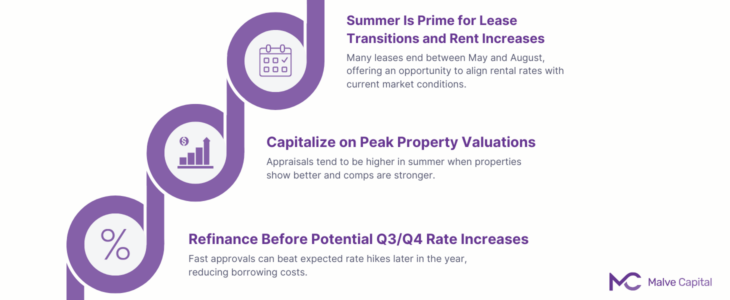

Why Summer Is the Smartest Time to Refinance Your Rental Property with Malve Capital

For real estate investors focused on long-term wealth building, timing your refinance matters just as much as finding the right lender. Summer offers unique advantages for refinancing rental properties—especially if you're looking to pull cash out to fund your next deal, lock in a long-term fixed rate, or lower monthly payments to...

Strategies for Real Estate Investors When Inventory is Scarce

Investing in the real estate market with limited inventory can feel like a constant uphill battle. Quality properties are harder to find, competition is fierce, and opportunities seem to disappear as quickly as they arise. For investors, this environment demands a creative, proactive approach. The good news? Scarce inventory doesn’t mean no...

How Do I Apply for a Hard Money Loan?

Hard money loans are well-suited for investors seeking quick, flexible financing solutions. Unlike traditional bank loans, hard money loans are asset-based and provided by private lenders. They focus primarily on the property's value rather than the borrower's creditworthiness. Here’s how to apply for a hard money loan with Malve Capital, the...

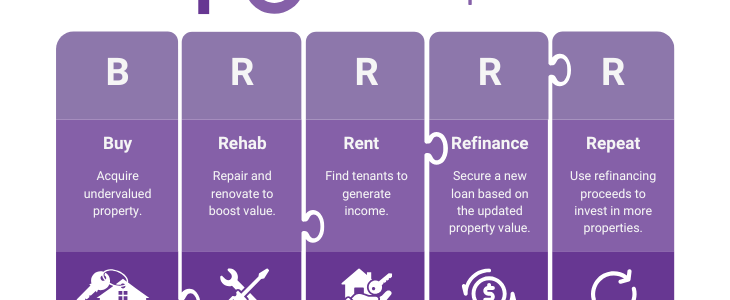

The BRRRR Method of Real Estate

For real estate investors, maximizing returns while building a sustainable portfolio is key to long-term success. One strategy gaining traction in recent years is the BRRRR method. BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat, and it’s a systematic approach to building wealth through real estate.

Whether new...

What Happens If Your Real Estate Sale Falls Through?

When a real estate sale falls through, it can be frustrating and stressful for both owners and investors. Whether the deal collapses due to financing issues, inspection problems, or a change of heart from the buyer, the outcome can leave you uncertain about your next steps. Understanding why the sale didn’t go...

Asset-Based Loans vs. Traditional Mortgages

Asset-based loans and traditional mortgages are two primary financing options. Traditional mortgages typically involve long approval processes, strict credit requirements, and fixed terms, making them ideal for stable borrowers seeking to purchase property.

By contrast, asset-based loans offer more flexibility, leveraging existing assets for quicker access to capital. These...

The Benefits of Partnering with a Trusted Lender for Your Real Estate Acquisition Needs

Choosing a trusted lender is crucial when navigating the complex world of real estate acquisitions. A reliable lender like Malve Capital provides financial support, invaluable expertise, and guidance.

With years of experience in the real estate lending industry, we have a well-earned reputation as lending experts who deliver reliability...

What Documentation Do You Need for a Smooth Loan Process?

At Malve Capital, we make the loan process as easy as possible. Whether you're looking for acquisition loans, asset-based loans, bridge loans, fix and flip loans, or development loans, we've got you covered. We know the importance of a smooth loan process, so we require minimal documentation. We aim to help...

How to Identify Profitable Real Estate Opportunities

Identifying profitable real estate opportunities is crucial for any successful investor. It can distinguish between a high return on investment and a financial loss. This blog covers essential strategies for finding lucrative properties. Whether you're a seasoned investor or just starting out, these tips will help you make informed decisions and maximize...

Multi-Unit vs. Single-Family Home Investing: Which One is Right For You?

Investing in real estate offers great opportunities for financial growth. When considering real estate, you might wonder whether to invest in single-family homes or multi-unit properties. Each option has benefits and challenges, and making the right choice can significantly impact your investment success.

This blog explores the differences between...

What Lenders Look For In First-Time Investors

Understanding what lenders look for as a first-time real estate investor can significantly increase your chances of securing a loan. Lenders have specific criteria to evaluate potential borrowers, and meeting these expectations is crucial.

At Malve Capital, we help first-time investors easily navigate the lending process. Our team...