Real Estate Equity Partnerships: Control vs. Ownership

Raising capital is part of scaling any real estate business—but what happens when the check comes with strings attached? For many first-time syndicators, aspiring developers, or mid-tier operators, the idea of bringing in an equity partner often feels like an all-or-nothing proposition: you get the capital, but lose control.

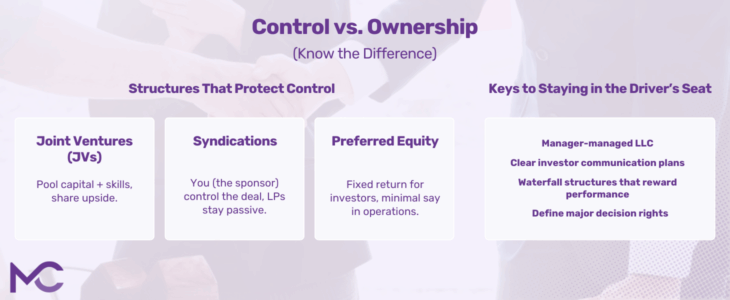

How to Leverage Equity Partners Without Giving Up Control

In real estate, control is everything. It’s your project, your vision, your risk—so why should someone else be calling the shots? For many new and growing investors, the idea of bringing in an equity partner raises a red flag: Will I lose control of my deal?

The good news?...

How to Fund Your First Fix and Flip Without Using a Bank

If you’re a first-time real estate investor, chances are you’ve asked: “How do I fund a fix-and-flip without a bank loan?” Between strict requirements, long timelines, and endless paperwork, traditional bank loans often feel like a dead end. Fortunately, there’s a faster, easier way—private lending.

In this guide, we’ll...

10 Terms Every First-Time Real Estate Investor Needs to Understand

Getting into real estate investing can feel like learning a new language. Between acronyms, underwriting jargon, and construction slang, it’s easy for a first-time investor to feel out of their depth before they even make an offer.

But here’s the truth: You don’t need to be an expert—you just...

How Asset Managers Use Private Lending to De-Risk Portfolios

When markets get choppy, great asset managers don’t just ride the wave—they rebalance the board. In an era defined by interest rate volatility, banking pullback, and erratic deal timelines, institutional and independent asset managers alike are turning to private lending as a tool not just for funding, but for de-risking.

4 Reasons Why Real Estate Investors Use Bridge Loans

In real estate, timing is everything. Whether you're scooping up an underpriced property at auction, racing to close before a competitor, or bridging the gap between purchase and permanent financing-delays kill deals.

That’s where bridge loans come in.

Bridge loans are short-term, asset-based loans designed to keep your deal alive while you transition from...

From First Flip to Full-Time: Scaling Your Business With Private Capital

Most real estate investors remember their first flip vividly—the nerves at the closing table, the scramble to manage a contractor, the thrill of watching a dated property transform under their budget and timeline. But for some, that first successful deal isn’t just a win—it’s a turning point.

The real...

5 Funding Mistakes First-Time Real Estate Investors Make (and How to Avoid Them)

Breaking into real estate investing is exciting—but it’s also loaded with landmines. For first-time investors, funding the deal is often where things fall apart. Whether it’s overestimating what banks will offer, underestimating timelines, or choosing the wrong partner, a bad funding move can destroy your margins - or the deal altogether.

Syndication vs. Joint Venture: Choosing the Right Structure for Growth

As a real estate investor, there comes a moment when you realize you can’t do it all alone. The single-family flips were a great starting point—but now, you're eyeing bigger opportunities: multi-unit renovations, ground-up construction, or acquiring mid-size rental portfolios. That’s when you face the question: should I structure this as a...

Funding Options for Real Estate Developers

There are several ways to fund a real estate project, including real estate development loans. Because banks are reluctant to finance developers, working with a private lender is essential. That’s where Malve Capital LLC comes in. We offer a variety of property development loans, with little documentation required, to get your...