How to Fund Your First Fix and Flip Without Using a Bank

If you’re a first-time real estate investor, chances are you’ve asked: “How do I fund a fix-and-flip without a bank loan?” Between strict requirements, long timelines, and endless paperwork, traditional bank loans often feel like a dead end. Fortunately, there’s a faster, easier way—private lending.

In this guide, we’ll...

4 Reasons Why Real Estate Investors Use Bridge Loans

In real estate, timing is everything. Whether you're scooping up an underpriced property at auction, racing to close before a competitor, or bridging the gap between purchase and permanent financing-delays kill deals.

That’s where bridge loans come in.

Bridge loans are short-term, asset-based loans designed to keep your deal alive while you transition from...

From First Flip to Full-Time: Scaling Your Business With Private Capital

Most real estate investors remember their first flip vividly—the nerves at the closing table, the scramble to manage a contractor, the thrill of watching a dated property transform under their budget and timeline. But for some, that first successful deal isn’t just a win—it’s a turning point.

The real...

5 Funding Mistakes First-Time Real Estate Investors Make (and How to Avoid Them)

Breaking into real estate investing is exciting—but it’s also loaded with landmines. For first-time investors, funding the deal is often where things fall apart. Whether it’s overestimating what banks will offer, underestimating timelines, or choosing the wrong partner, a bad funding move can destroy your margins - or the deal altogether.

Fix and Flip in a Hot Market: How to Stay Competitive With Fast Cash Offers

If you’ve tried to land a fix-and-flip deal in the last year, you know the drill: by the time you finish your walk-through, four offers are already in—and one of them is cash. It’s no secret that competition is fierce in today’s real estate market. Demand is outpacing supply in dozens of...

Syndication vs. Joint Venture: Choosing the Right Structure for Growth

As a real estate investor, there comes a moment when you realize you can’t do it all alone. The single-family flips were a great starting point—but now, you're eyeing bigger opportunities: multi-unit renovations, ground-up construction, or acquiring mid-size rental portfolios. That’s when you face the question: should I structure this as a...

The 5 Fastest-Growing States for Real Estate Investors in 2025 (And How to Fund Deals There)

In real estate investing, timing and geography are everything. And in 2025, investors across the country are tracking five states that are exploding in both population and opportunity. Whether it’s surging rental demand, booming job markets, or investor-friendly policies, these markets are becoming magnets for deal-makers—if you can fund fast enough to...

Private Lending in a Tight Credit Market: Why It’s Booming

In a world where access to capital defines your pace and potential, the rules of the game are changing fast. Over the last 18 months, banks have pulled back—tightening credit requirements, slashing approvals, and increasing the scrutiny on every single borrower.

But one sector hasn’t flinched: private lending. In...

How to Build a Reliable Financing Stack in Unpredictable Markets

In 2025, one thing is certain: the market is uncertain. Interest rates remain volatile, traditional banks are tightening credit, and deal timelines are compressed. For real estate investors, that means a static capital strategy is a liability. The investors who will thrive in this cycle are those who know how to stack...

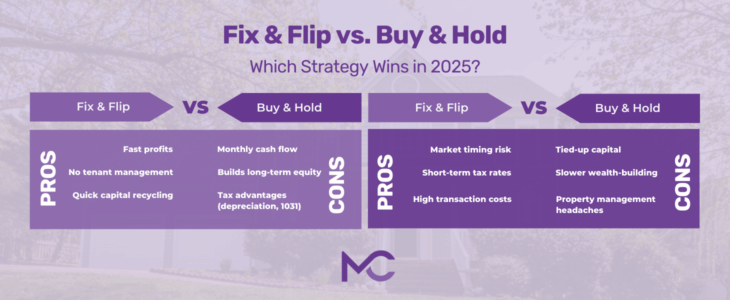

Fix and Flip vs. Buy and Hold: Which Strategy Wins in Today’s Market?

If you’re exploring real estate investing in 2025, you’ve likely asked yourself: “Should I flip this house or rent it out long term?” It’s one of the most critical decisions an investor can make—and it comes down to your goals, risk tolerance, and how quickly you need capital to work for you.

Maximizing Returns: Using Fix & Flip Loans to Transform Distressed Properties

Transforming distressed properties into high-value assets is an exciting and potentially lucrative opportunity for real estate investors. Fix-and-flip loans offer the flexibility and funding needed to complete renovations and maximize returns. Here’s how you can leverage fix-and-flip loans to turn distressed properties into profitable investments.

What Is a...

Fix and Flip Loans for the Experienced Investor

At Malve Capital, we understand that seasoned investors seek more than just essential financing—they need strategic partners who amplify their profits and efficiency. That's why savvy house flippers turn to us for their fix-and-flip loans.

Our deep understanding of the real estate market and customized loan options ensure that...

What Are The Key Features of Fix-and-Flip Loans

Fix-and-flip loans are a source of funding for real estate investors who purchase properties to renovate and sell them for a profit. These loans cover not only the purchase price of the property but also the cost of renovations. They are particularly appealing for projects that need a quick turnaround, as the...

Uncovering Hidden Value: The Profit Potential of Flipping Distressed Properties

Investing in distressed properties with fix and flip loans offers a lucrative opportunity for savvy investors. These properties, often in need of repair or renovation, can be transformed and sold for a substantial profit.

At Malve Capital, we provide flexible fix and flip loans, tailored to fit the...

Creating a Successful Fix and Flip Budget: Tips and Tricks

Fix-and-flips refer to the process of buying properties, renovating them, and selling them for profit. Success in this game often comes down to one crucial element: budgeting. A solid fix-and-flip budget ensures you maximize profit while avoiding unexpected costs. And working with an alternative lender like Malve Capital can keep your...

Strategies to Maximize Your Return on a Construction Investment

For the ambitious builder, every construction project is not just about bricks and mortar but the promise of a lucrative return on investment (ROI). As specialists in fix and flip loans, Malve Capital understands the intricacies of the construction sector. This blog will explore strategies to amplify your returns and turn...

How to Estimate the ROI for a Fix and Flip Loan

Engaging in a successful fix-and-flip venture requires a comprehensive understanding of its financial aspects, notably calculating Return on Investment (ROI). Estimating ROI is essential to ensure the profitability of property investments. Every decision—from the choice of property to the extent of renovations—has significant implications for the anticipated return. This blog explains...

Fix and Flip Loans: Do banks or private lenders offer the best terms?

Flipping real estate can be a lucrative undertaking if structured properly. A significant challenge facing investors is obtaining the necessary funding for their ventures. Given that real estate flips often require swift action and significant amounts of money, determining the best source for your loan is pivotal. So, should you approach traditional...