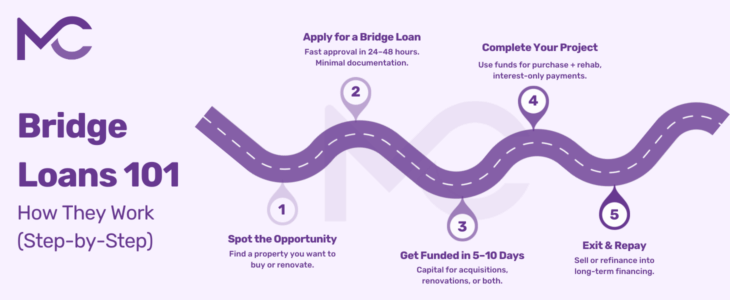

Bridge Loans 101: Fast Capital for Acquisitions, Renovations, or Both

Real estate is all about timing. A hot deal doesn’t wait for a bank’s approval process—and most traditional lenders move far too slow. For investors navigating acquisitions, renovations, or transitions between properties, bridge loans offer a lifeline.

But what exactly is a bridge loan? When does it make sense...

A Contractor’s Guide to Getting Paid Faster With Bridge Loans

If you’re a contractor who’s ever fronted labor or materials while waiting weeks—sometimes months—for a check to clear, you already know the #1 threat to your business: cash flow delays.

Whether you're managing your own fix-and-flip project or working with investors, waiting on traditional financing can grind a job...

4 Reasons Why Real Estate Investors Use Bridge Loans

In real estate, timing is everything. Whether you're scooping up an underpriced property at auction, racing to close before a competitor, or bridging the gap between purchase and permanent financing-delays kill deals.

That’s where bridge loans come in.

Bridge loans are short-term, asset-based loans designed to keep your deal alive while you transition from...

From First Flip to Full-Time: Scaling Your Business With Private Capital

Most real estate investors remember their first flip vividly—the nerves at the closing table, the scramble to manage a contractor, the thrill of watching a dated property transform under their budget and timeline. But for some, that first successful deal isn’t just a win—it’s a turning point.

The real...

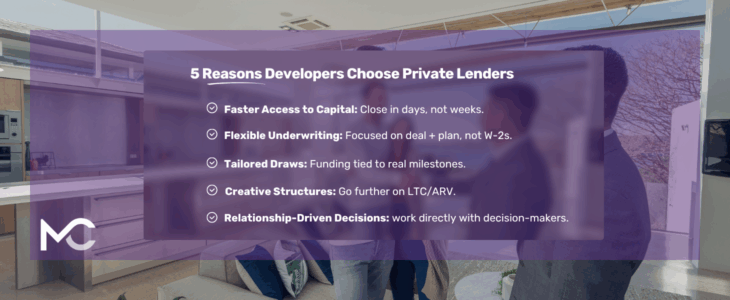

Why Smart Developers Are Partnering With Private Lenders in 2025

In a year where capital is tight and competition is fierce, smart real estate developers are rethinking how they fund deals. With traditional banks tightening credit requirements and taking weeks to approve loans, private lenders are becoming the go-to capital partners for developers who value speed, certainty, and flexibility.

How Construction Loans Support Sustainable Projects

Sustainable building practices are transforming the real estate industry, with more developers opting for eco-friendly construction methods. However, these projects often require substantial upfront costs, making construction loans essential to financing. Here’s how construction loans support sustainable projects and contribute to a greener future.

Funding Green Building Materials

Top 5 Considerations for Choosing a Construction Loan Lender

Working with the right construction loan lender can make all the difference in your project's success. It can impact your financing options, project timeline, and overall experience. A knowledgeable and reliable lender ensures you get favorable terms, necessary flexibility, and strong support throughout the construction process.

Choosing Malve...

Avoiding Cost Overruns: Managing Your Budget with a Construction Loan

Managing your budget effectively in construction projects is not just important, it's essential. Construction loans can provide the necessary funds to bring your project to life, but they also require meticulous management to prevent financial overflow.

This blog will walk you through the crucial steps of leveraging construction...

Construction Loans: Fixed vs. Variable Interest Rates – Which is Right for You?

Construction loans are pivotal for turning development dreams into reality. Understanding the nuances of these loans, particularly the types of interest rates available is crucial for developers. This blog explores the differences between fixed and variable interest rates in construction loans, helping you make informed decisions for your projects.

Alternative Financing: Comparing Construction Loans to Other Funding Options

In today's dynamic real estate market, the demand for varied financing options has never been higher. With the evolving landscape of construction financing, private lenders like Malve Capital are emerging as game-changers, providing an array of products beyond the traditional construction loan. Let’s explore what sets these alternatives apart and how...

Securing the Best Terms for Your Construction Loan: Tips and Tricks

Securing financing for construction projects can be complex and challenging for both seasoned developers and first-time builders. Traditional banks often have rigorous criteria, and their processes can be cumbersome. That's where Malve Capital can make all the difference, providing flexible solutions tailored to your unique needs. This guide is to help you...

How to Finance a Real Estate Flip

Flipping houses and other properties can be lucrative. However, there are costs to consider, including acquisition, renovation, and holding costs. Developers and investors frequently turn to Malve Capital LLC to secure financing. We require minimal documents and offer fast closings, competitive rates, and an easy process. Contact us today to get...

Funding Options for Real Estate Developers

There are several ways to fund a real estate project, including real estate development loans. Because banks are reluctant to finance developers, working with a private lender is essential. That’s where Malve Capital LLC comes in. We offer a variety of property development loans, with little documentation required, to get your...